Make your donations go even further!

Did you know that your charitable donations are tax deductible? Donations made to Oxfam Aotearoa are eligible for a tax credit from IRD. Most people can get 33.33% back, some even more! By claiming your tax credit and donating it back to Oxfam, your generosity will go even further. Your year-end credit will be used where it’s needed most – fighting poverty and inequality around the world.

Don't let your tax credits go to waste. Claim yours today and make an even bigger impact!

How to claim your tax credits online

To claim your donation tax credit, you can do this online by simply using your donation tax receipt – either a pdf, photo or scanned version of the physical document.

You will need a myIR login or alternatively a RealMe login. If you do not have one, please take note when you are signing up that you want to be able to receive donation tax credits. You will need your IRD number.

To make it easy, we have put together a step-by-step guide for you.

To get started log on to your myIR account here.

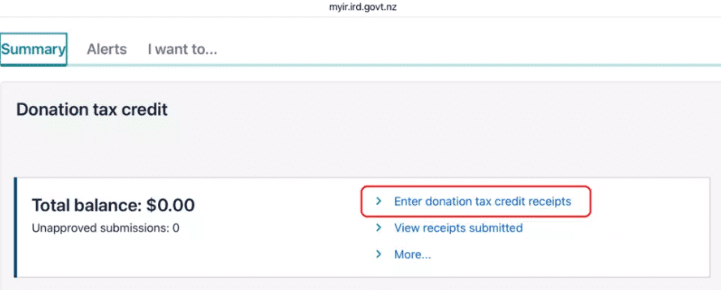

2. Home Page - Summary Tab

Find the ‘Donation tax credit’ section

Click on the ‘Enter donation tax credit receipts’ button

If ‘Donation tax credit’ is not an option on your home page, you can add it by going to ‘I want to…’ section then ‘Register for donation tax credit’, and fill in the registration form then submit it to the IRD.

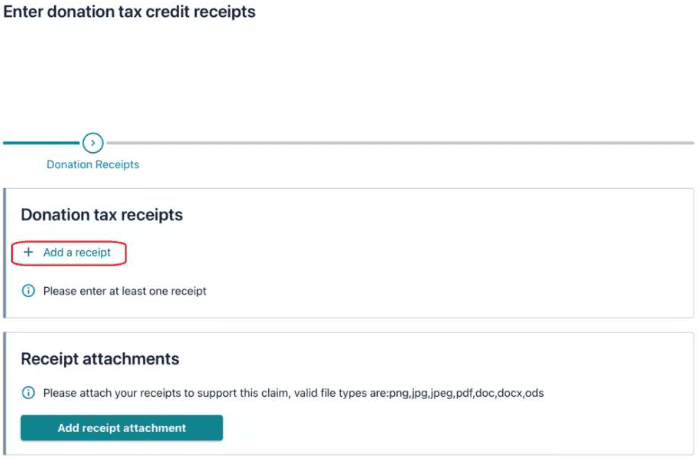

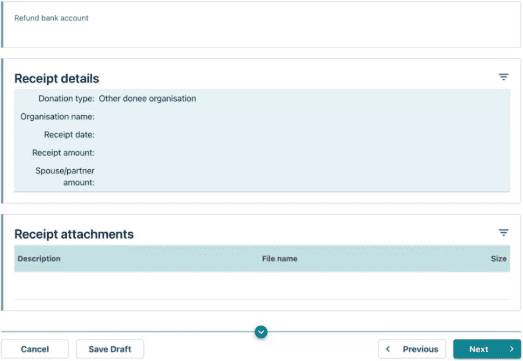

3. Add Receipt Details

Click the ‘+ Add a receipt’ button and fill in the details

Organisation name: Oxfam Aotearoa

Organisation IRD number: 056-901-930

Organisation charity registration number: CC24641

Donation type: Other donee organisation

Receipt Date: Add the date that is on your receipt

Receipt amount: Add the amount that is on your receipt

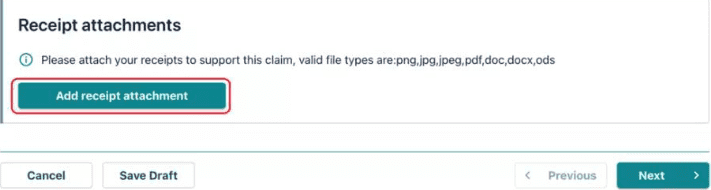

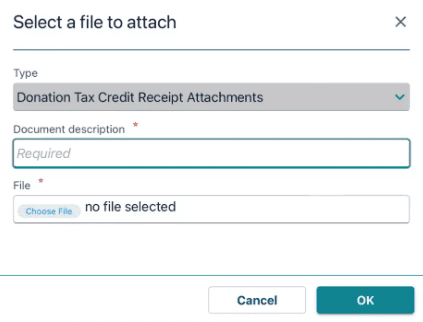

4. Receipt Attachment

Click on ‘Add receipt attachment’ button and fill in the details

Type: Donation Tax Credit

Document description: example name Tax Receipt 2025

File: Attach the receipt. If you have a physical copy the IRD will also accept a scan or a photo of the receipt.

Once all of the required fields have been filled in you can press ‘OK’

Then select ’Next’

5. Summary of the Receipt Details

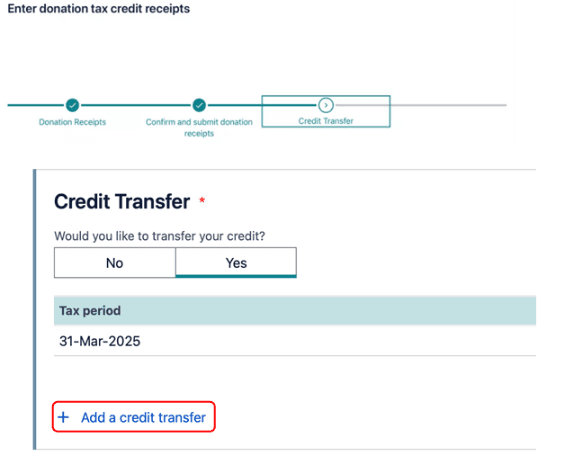

6. Credit Transfer & Submit for Processing

Choose whether to transfer the donation tax credit

Click ‘Yes‘ if you wish to donate some or all of your tax credit back Oxfam Aotearoa and if so, thank you so much, you’re amazing!

If you would like the credit to come back to you click ‘No‘ and ‘Submit’

Click the ‘+ Add a credit transfer’ button and then fill in the following fields:

IRD Number: 056-901-930

Account type field from dropdown is: Donation tax credit

Period from: Select the first date in the list

Period to: Add the same date you selected in ‘Period from’

Transfer amount: Add in the amount you are transferring

Click on the ‘Submit’ button and you’re all done!

Want to claim your tax credits the traditional way?

1. Complete tax form IR526

Check your details and IRD number are correct as well as your donation details. Be sure to sign the form and attach all donation certificates. Download form here

2. Donate your tax credits back to Oxfam

Complete Box 9 on the form with our info:

ANZ Bank 01-0202-0117805-04.

Add TAX CREDIT as the reference

3. Post your tax credits form

Post your tax credits claim form back to: Inland Revenue Department, PO Box 39090 Wellington Mail Centre Lower Hutt 5045. You can contact the IRD here.

Other ways to donate your tax credits back

Donate a general gift online here.

Donate to our latest Emergency Appeal here.

Call us on 0800 600 700 between 9am to 5pm to donate over the phone

Account Number: 01-0202-0117805-04

Account Name: Oxfam NZ

Particulars: 'Your Name'

Code: Your supporter number (if you know it), otherwise first part of your mailing address or email

Reference: Tax Credit

However you decide to donate your tax credit, THANK YOU for your continued generosity! You just increased your impact and helped us do even more to fight poverty and inequality around the world. Ngā mihi nui.