Blog by Nick Bryer, Oxfam Global Inequality Lead

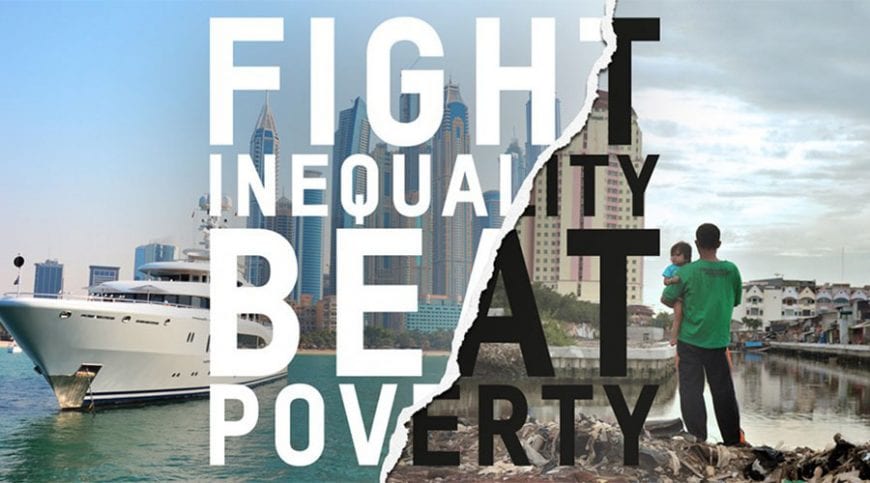

Our new report about the state of inequality in the world reveals how our economy is delivering unimaginable rewards for those at the top by exploiting millions of ordinary workers at the bottom.

As soon as we published it, we started to receive lots of great comments and questions. Here are some of the most interesting questions we’ve been asked, and our answers to them.

1. “Poverty is going down globally. People are living longer, healthier lives. Why should we care if a few people are also getting really rich?”

It’s absolutely true – and absolutely brilliant – that extreme poverty has declined very significantly over the past 25 years. In fact, the number of people living in extreme poverty – which is defined as anyone living on less than $1.90 a day – has more than halved. However, there are several reasons why that doesn’t mean we can now put our feet up, or even carry on along the same path that we’ve been going down.

Over this same time period, inequality has been increasing within most countries, and is now at dangerously high levels. There’s a great deal of evidence to show that extreme inequality leads to very negative social, political and economic impacts. It also stands in the way of the fight against poverty. Yes – lots of people have lifted themselves out of extreme poverty in recent years, especially in countries like China, but the data shows that 700 million more people could have been lifted out of poverty by the end of last decade if inequality had been reduced at the same time.

Also, while the number of people in extreme poverty has reduced, there are a huge number of people who are poor but not ‘extremely poor’ because they earn slightly more than $1.90 a day. They still work very long hours in difficult and dangerous jobs, and they are still struggling to make ends meet. This includes many of the people who grow our food and make our clothes. They work in global supply chains that are channelling huge wealth to those at the top, while failing to pay a living wage to those at the bottom.

How can we accept such injustice?

Join the movement to fight inequality and beat poverty

2. “Oxfam is a charity – why are you talking about politics?”

Ending poverty is Oxfam’s reason for being – but we know that we can’t achieve our goal unless we work with others to tackle the big, structural issues that push people into poverty and keep them trapped there.

This means addressing really big challenges such as economic inequality, gender discrimination and climate change. And these problems are all fundamentally about power.

To understand their causes and to find solutions, we have to look at who has been making the big decisions, whose interests they have been acting in and whose voices have been excluded. We also have to look at who has the responsibility and the ability to put things right – and very often that means challenging governments to make better decisions.

3. “Oxfam keeps criticizing big companies. Are you anti-business?”

We’ve been asked this a few times over the years, but it simply isn’t true. Much of Oxfam’s work involves actively supporting and developing enterprises in communities around the world. We have productive partnerships with many companies, large and small.

What we are against is the kind of business model that maximizes profits by paying poverty wages, endangering workers, trashing the planet, or aggressively dodging tax. We are happy to be seen as anti those kinds of business.

We want to see companies showing that there is a different way of doing business – that profit is not the only thing that matters to them.

We want to see governments regulating against bad business practices, and actively supporting more positive ones. That includes encouraging the development of alternative business models that have a social purpose at their heart and that distribute power and profit more fairly among their different stakeholders.

4. “Last year you said that 8 men owned the same wealth as half the world. Now, you’re saying that it’s 42. So it sounds like inequality is getting better – but you’ve also just said it’s getting worse! Which is it?”

Unfortunately, those two numbers aren’t directly comparable. We base these statistics on data from the Forbes Rich List and from the Credit Suisse Global Wealth Report. Credit Suisse is the most reliable source for data on how much wealth is held by different sections of the global population – including the value of stocks and shares, housing, livestock etc. That’s obviously a very difficult thing to calculate so they’re always trying to add to and improve their data sources. That means we can’t always compare a new figure with something we’ve published in the past.

To work out how inequality is changing over time, we need to re-calculate the figures for previous years using the latest data set. When Oxfam did this we found that actually 61 people owned the same wealth as half the world in 2016 (rather than 8). And that 61 has now dropped down to 42, which is consistent with all the other evidence showing how wealth inequality is increasing.

The really important point here isn’t whether it’s 8 or 42 or 100 people who have the same wealth as half the world. The point is that an elite group of billionaires – mostly men – are rich beyond their wildest dreams, while 3.7 billion people have less than 1% of the world’s wealth between them. And that enormous imbalance in wealth translates into an enormous imbalance of power and opportunity.

5. “Oxfam talks as though the economic pie cannot grow, and so it’s just a question of sharing that pie out more equally. But that’s obviously not true. If the economy grows, there will be more for everyone. And billionaires are the real wealth creators, driving that economic growth, so why shouldn’t they be rewarded for that?”

Of course, economic growth can bring benefits with it – but at the moment, we see that those benefits are mostly going to those at the top. 82% of the wealth created in the world last year went to the top 1%. We need both governments and businesses to take action to ensure growth benefits everyone – and particularly those at the bottom.

Economic growth isn’t driven by the actions of a few entrepreneurs. It’s built on the labour of millions of ordinary people who make things, grow things, buy things. Everyone has a right to share in the benefits of that growth.

The IMF have recently shown that redistribution – taxing the rich more and using the proceeds to pay for public services for everyone – is a great way of tackling inequality, and doesn’t have a negative effect on economic growth.

While inclusive economic growth is going to play a really important role in ending poverty in many countries, we also know that we have to tackle inequality at the same time, or we’ll destroy the planet that we all depend upon. With current levels of inequality, our global economy would need to grow 175 times bigger before everyone was able to earn $5 a day. That’s obviously completely unsustainable.

We have to find a different and better route to shared prosperity.

We are asking people to help spread the word and to join with us to demand governments and big businesses do things differently.